How Odeka is implementing tax reform in the Democratic Republic of Congo using SurveyCTO

Meet ODEKA

ODEKA (L’Organisation d’Etudes Economiques au Kasaï) is a nonprofit research organization founded in 2013. Based in the province of Central Kasai in the Democratic Republic of Congo (DRC), they are working on a joint research project on the digitization of tax collection across the Congo in collaboration with the Congolese provincial government, and the University of California at Berkeley.

Office: Kananga, Democratic Republic of Congo

Sector: Research

Use case: Field data collection, international development, academic research

Features used: Advanced offline, case management

The Challenge: Collecting property data for 130,000+ properties in areas with no internet while minimizing duplicate data collection

In lower-income countries like the Democratic Republic of the Congo, tax compliance is often low. This results in minimal revenue for local governments and scant resources to invest in public goods like infrastructure, healthcare, transportation, and education. Many efforts have been made to address these challenges, including the formation of the International Center for Tax & Development (ICTD), an independent research centre focused on improving tax policy and administration in lower-income countries.

In 2023, to explore the potential for changes to tax structures and enforcement in the DRC, the Fund for Innovation and Development (FID) and the International Centre for Tax and Development (ICTD) began funding an ambitious public policy project initiated by the Provincial Government of Kasaï-Central. The project combines tax policy implementation, impact evaluation, and academic research, in collaboration with the University of California at Berkeley.

The data collection for this evaluation project was led by research NGO ODEKA. The goal was to reform the property tax in Kananga, the capital city of the Central Kasai Province, and explore how changes to its tax system might increase tax compliance, and therefore public revenue.

The project involved multiple phases. The first phase consisted in assessing the value of all properties in the city of Kananga in order to build the province’s first comprehensive property registry. In the second phase, a pilot tax campaign was launched to test three different property tax systems, with the goal of understanding which design would perform best in terms of taxpayer compliance, perceived fairness, and collector performance. Based on the results, the plan was to scale the most effective system in a third phase, alongside the introduction of new tools to support tax collection.

The first phase was perhaps the most crucial. How could the provincial government properly tax its residents if there was no understanding of property value? Therefore, ODEKA had to create a comprehensive database of all the properties in the 432 neighborhoods of Kananga and their associated values.

Initially, ODEKA’s data collection team used open-source software for their surveys. However, the open-source software lacked online servers where collected data could be securely stored, and did not enable the offline transfer of data between forms on the same device, both of which were ideal for ODEKA’s data collection plan.

Another issue was the sheer volume of data being collected. The initial estimate for the number of properties to survey was thought to be 60,000. However, ODEKA soon discovered that the number was closer to 130,000, more than double what was initially planned for. Additionally, not only were there so many properties to capture data on, each property had numerous characteristics that needed to be logged and organized. This made data management and exporting very time-consuming and tedious.

ODEKA decided they needed a different approach to this ambitious project. They needed to start building out the registry of taxable properties, and wanted a more efficient way to conduct this part of their research.

The solution: Using SurveyCTO’s mobile app as well as offline functionality and case management features

In 2023, while exploring data collection software options, ODEKA learned about SurveyCTO and their Collect mobile app. ODEKA decided to switch from their open-source tool to SurveyCTO to use this app. In 2024, they added the advanced offline features and began using them in combination with case management to collect the data needed for the first phase of building out the Kananga property registry.

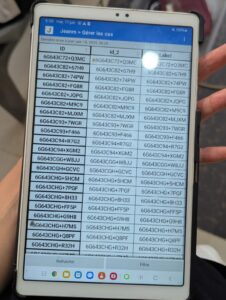

ODEKA had previously mapped out the city using Google Plus Codes as a way to identify buildings. With SurveyCTO’s case management feature, they were able to:

- Set each building up as cases using their Google Plus Codes as the unique identifier

- Assign buildings to enumerators—each enumerator had more than a 1,000 total assignments!

- Get rid of paper lists for each enumerator’s assigned households

- Aggregate all data collected for each household

- Prevent duplication of surveys by enabling the immediate closing of cases once a survey was complete—even when internet was not available

- Sync data from devices with SurveyCTO servers daily in areas where internet was available

- Use SurveyCTO’s data monitoring tools to ensure data quality

The data collection team was also able to take advantage of SurveyCTO’s support for additional advice to optimize their project.

“There were times where the internet was nonexistent, and so SurveyCTO’s support team taught us how to use the local storage of the computer to avoid using the internet connection to upload forms and extract data and this was also super useful,” says Manon Bellot, ODEKA Field Supervisor for this project, and a Predoctoral Fellow at Haas School of Business at the University of California at Berkeley.

The results: Reforming Kananga’s tax structure

Using the data gathered by ODEKA, public authorities in Kananga implemented a tax reform campaign for property taxes. While each property tax system explored in the evaluation had pros and cons, the system currently selected by local authorities has increased tax participation, and increased public revenue.

Successfully building out the tax registry also empowered ODEKA to carry out additional research in the DRC. The same team of enumerators who had originally collected property data using SurveyCTO also went out into the field to document the efficacy of and adherence to the new tax structure.

Further, after the success of this project in Central Kasai Province, it is now being scaled to other provinces across the country. The ODEKA team will return to the DRC once more to manage this research—again, using SurveyCTO.